The

U.S. Labor Market Report covering the national employment situation in November

showed a gain of 211,000 nonfarm jobs. The unemployment rate held steady at

5.0%. The average workweek edged down by 0.1 hour to 34.5 hours, but the

average hourly wage increased by four cents to $25.25. Over the year, average

hourly earnings were up by 2.3%.

The employer payroll

survey reported that total nonfarm employment in the United States increased by

211,000 jobs in November. The private sector contributed 197,000 jobs to the

November increase, while the public sector added 14,000 jobs with gains at all

three levels of government: federal, state and local. Employment growth was

broad based with nearly every major industry sector adding jobs over the month.

The exceptions were manufacturing, hurt by weak export growth and the strong

dollar, mining and logging (primarily in the energy extraction sector), and

information. There was also a positive

net revision to the September and October figures of 35,000 jobs. Over the past

three months, job gains have averaged 218,000 per month. The 2015 year-to-date

average monthly gain was 220,000 jobs, somewhat below the 253,000 figure recorded

for the same period in 2014.

On a year-to-year basis,

U.S. employment expanded by 2.637 million jobs, an increase of 1.9%. In

year-to-year terms (YTY), mining and logging was the only major industry to

record a decline with a loss of 123,000 jobs (-13.5%). The largest YTY gain

occurred in health care and social assistance with 580,800 jobs added over the

year, an increase of 3.2%. Leisure and hospitality added 438,000 jobs (up

2.9%). Professional and technical services also posted a strong gain (298,400

jobs, 3.5%), as did retail trade (284,200 jobs, 1.8%).

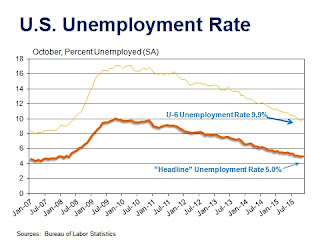

Turning to the household

survey, in November, the unemployment rate held steady over the month at 5.0%

and was down from the year-ago rate of 5.8%. The labor force participation rate

increased slightly over the month, rising to 62.5% and bringing 273,000 workers

into the workforce. Last year at this time, it was 62.9%.

The more comprehensive U-6

unemployment rate was 9.9%, well below the 20-year average for this indicator

of 10.7%. The U-6 unemployment rate counts part-time workers who would prefer

full-time work and individuals who would like to work but have given up looking

for a job.

Other indicators also

demonstrate labor market slack is diminishing. The share of workers who have

been jobless for 27 weeks or more dropped to 25.7% of all unemployed persons,

down from the year ago rate of 31.0%. The average rate going back to 1990 is

25%. Over the past 12 months, the number of long-term unemployed persons has

fallen by 782,000. The median duration of unemployment is also on the decline,

falling from 12.8 weeks in November 2014 to 10.9 weeks last month.

Summary: The

labor markets delivered another strong performance in November. With

manufacturing jobs edging lower last month, and mining employment falling for

the 11th consecutive month, the services sector delivered 163,000 jobs, while

the rebound in residential and nonresidential construction pushed construction employment

higher by 46,000 jobs. Overall job growth has kept the unemployment rate steady

at its lowest rate in seven years, and wage growth continues to outpace

inflation.

No comments:

Post a Comment