The Employment

Development Department (EDD) released the state and local employment reports

for the month of November. Total California nonfarm employment increased by

5,500 jobs over the month in seasonally adjusted (SA) terms. Before adjusting

for seasonality, the gain was 78,600 jobs. The year-over-year change showed an

increase of 417,100 jobs (SA). This equated to a growth rate of 2.6%. This was

the slowest rate of increase since September 2012 when it was 2.5%, but still

exceeded the November national increase of 1.9%. California’s private sector

added 378,400 jobs (an increase of 2.8% over the year), while employment in the

public sector rose by 1.6% (38,700 jobs).

Industry

employment held to trend in November with nine of the 11 super-sectors adding

jobs over the year: construction; trade, transportation and utilities;

information; financial activities; professional and business services;

educational and health services; leisure and hospitality; other services; and

government for a combined gain of 424,300 jobs. Professional and business

services posted the largest gain on a numerical basis, adding 116,000 jobs (up

4.7%), while construction continues to claim the largest gain in percentage

terms, increasing by 5.9% and adding 41,000 jobs.

Two industry sectors

recorded a decline in November. Mining and logging employment dropped by 9.3%,

a loss of 2,900 jobs, while manufacturing employment was down by 0.3% or 4,300

jobs.

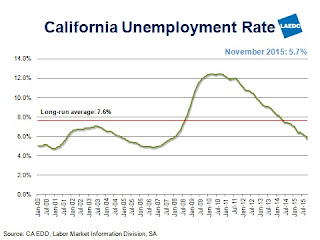

California’s

unemployment rate declined slightly from 5.8% in October to 5.7% in November

and was down from the year ago rate of 7.2%. California’s unemployment rate is

now the lowest it has been since November 2007 when it was also 5.7%. The

number of employed persons in California now stands at 17,910,100 (an increase

of 2.1% over the year), while the number of unemployed workers tumbled by 20.2%

over the same period to 1,081,800 in November. Although California has been

working its way up the ranks, it still had the 13th highest

unemployment rate in the nation last month, while at 2.7%, North Dakota had the

lowest.

County

highlights:

(Note: With the exception of the Los Angeles

unemployment rate, county level numbers are not seasonally adjusted, which

means there can be large month-to-month fluctuations in job counts. A truer

picture of how local labor markets are faring is revealed by focusing on the

year-over-year numbers. Annual trends “correct” for the seasonal factors that

influence certain industry sectors over the course of the year.)

In Los Angeles

County, the seasonally adjusted unemployment rate was 5.9%, down from 6.0% in October

and below the year ago rate of 8.0%. Total nonfarm employment (not seasonally

adjusted) increased by 22,200 jobs over the month and was up over the year by 73,200

jobs, an increase of 1.7%.

Educational and

health services posted the largest year-over-year gain in employment in November

with a net increase of 22,400 jobs. The health care industry added 24,800 jobs,

but a decline of 2,400 jobs in educational services partially offset the

increase.

Also recording

significant job gains were leisure and hospitality, which picked up 19,700

jobs, 87% of which were in accommodation and food services, and professional

and business services employment with the addition 15,900 jobs.

Four major

industry sectors reported year-over-year declines in November: manufacturing

employment contracted by 7,500 jobs; information lost 7,300 jobs; financial

activities was down by 300 jobs, and in the mining and logging sector, job

counts fell by 400.

In November, the

unemployment rate in Orange County was 4.2%, down from 4.3% in October and below

the year-ago figure of 5.2%. Nonfarm payroll jobs increased by 11,600 over the

month and were up by 39,000 over the year (an increase of 2.5%).

In the

Riverside-San Bernardino area, the unemployment rate in November was 6.1% compared

with 6.3% in October and below the year ago estimate of 7.6%. The Inland Empire

gained 17,900 nonfarm payroll jobs over the month and 46,100 over the year.

This represented an increase of 3.5%.

In Ventura

County, the unemployment rate was 5.4%, unchanged over the month but down from

the year ago estimate of 6.6%. Total nonfarm employment was up by 2,400 jobs

over the month and by 8,500 jobs over the year (up by 2.9%).

Summary: California led the

nation with the largest annual wage and salary job gain of 417,100 in November,

while the unemployment rate fell to its lowest in over eight years. In Southern

California, every region saw decreases in unemployment rates and job gains in

key industries such as health care, professional and business services,

construction, and leisure and hospitality.